INVESTMENTS

OUR OFFERINGS

Terra Capital offerings. Join our email list by clicking the “invest with us” button to be updated about current and future investment opportunities.

If you're interested in learning more about Terra's upcoming sub-institutional value-add multifamily opportunities: Register Here

Grursus mal suada faci lisis dolarorit ametion att consectetur elit. Vesti at bulum nec odio aea the rsus fadolorit the consectetur elit.

Terra Capital offerings. Join our email list by clicking the “invest with us” button to be updated about current and future investment opportunities.

2021

Exited mixed-use value-add

syndication in Brooklyn

Hold Time

Exit IRR

Equity Multiple

2022

Exited mixed-use value-add

syndication in Brooklyn

Hold Time

Exit IRR

Equity Multiple

2022

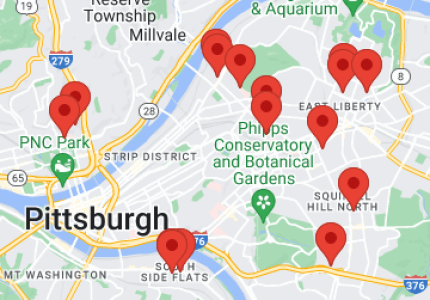

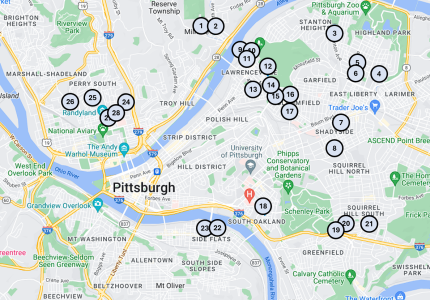

Fully funded and deployed in

Pittsburgh, PA,

value-add multifamily portfolio.

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

2023

Value-add SMF in Pittsburgh, Columbus and Indianapolis.

Hold Time

Proj. IRR

Projected Equity Multiple

2023

Value-add WFH Syndication in Indianapolis IA – 60-Units.

Hold Time

Projected IRR

Projected Equity Multiple

2024

Value-add Multifamily in Indianapolis IA – 38-Units.

Hold Time

Projected IRR on 3-Year hold

Projected Equity Multiple

2024

Value-add SMF in Pittsburgh PA – 64-Units

Hold Time

Proj.

Shadyside

2024

Value-add WFH Syndication in Indianapolis IA – 84-Units.

Hold Time

Projected IRR

Projected Equity Multiple

2025

Value-add Midwestern Multifamily Aggregation Strategy

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

December 2021

Exited mixed-use value-add

syndication in Brooklyn

Hold Time

Exit IRR

Equity Multiple

May 2022

Exited mixed-use value-add

syndication in Brooklyn

Hold Time

Exit IRR

Equity Multiple

June 2022

Fully funded and deployed in

Pittsburgh, PA,

value-add multifamily portfolio.

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Sept 2022

Terra Capital’s Second Midwest

year hold

Target

Multiple

December 2021

Exited mixed-use value-add

syndication in Brooklyn

Hold Time

Exit IRR

Equity Multiple

May 2022

Exited mixed-use value-add

syndication in Brooklyn

Hold Time

Exit IRR

Equity Multiple

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Sept 2022

Terra Capital’s Second Midwest

year hold

Target

Multiple

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Sept 2022

Terra Capital’s Second Midwest

year hold

Target

Multiple

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Sept 2022

Terra Capital’s Second Midwest

year hold

Target

Multiple

Total Units

Projected IRR on 5-Year hold

Projected Stabilized Cap Rate

Sept 2022

Terra Capital’s Second Midwest

year hold

Target

Multiple

June 2021

CashGrowth™ mobile home park fund across multiple markets

Total Units

Projected AAR

Projected Avg CoC

July 2021

Three apartment complexes located in Eagle County, Colorado

Total Units

Projected AAR

Projected Avg CoC

Total Units

Projected AAR

Projected Avg

Total Units

Projected AAR

Projected Avg CoC

Total Units

Projected AAR

Projected Avg CoC

Total Units

Projected AAR

Projected Avg

Total Units

Projected AAR

Projected Avg CoC

Total Units

Projected AAR

Projected Avg CoC

Total Units

Projected AAR

Projected Avg